Dionne Wilson, Director of Harcourts City Residential has prepared some information specifically for owners thinking of selling their apartments less than 50m2, Studio Apartments, Student Accommodation or Serviced Apartments.

….We are very experienced and highly regarded when it comes to selling studio apartments, very small apartments, serviced apartments and student accommodation (or what Banks deem as Student accommodation even if it can be owner occupied) we understand the challenges faced when putting them on the market.

What most people don’t realise is these properties should not be regarded the same as traditional real estate.

The number one challenge we face is the banks unwillingness to lend on properties that are so small in size or restricted in use. Due to this we need to target the property towards astute investors who are cash buyers and not reliant on the banks.

To attract this type of buyer the property needs to have an attractive return.

The market for these properties very much follows interest rates more so than the traditional real estate market. When interest rates go up, your price will fall. The reason being, investors are looking for an incentive to invest in these rather than having their money sitting in a long term deposit earning high interest. Investors will need 200-300 basis points (2-3%) more than they could achieve by having their money in the bank to invest.

Given that your rent does not go up when interest rates do, the only adjustment that can be made to provide the return is to reduce the asking price. Astute investors know that these properties do not grow in capital but provide a high return. That is their place in the market and hence there is no point taking the property to the market if we cannot offer a good return on the property. In the current market it requires an 8-10% return to attract the correct buyers anything less will prove to be a waste of time and a waste of your marketing money. It will also cause your property to sit unsold and tarnish the reputation of the property for future sale attempts. The public can see it’s sat unsold for a long period and will ask them-selves “I wonder what’s wrong with that property?”

Great news! We have a specific structure and plan to ensure the successful sale of your property.

We are frequently called in as a second agent when an original agent represents these types of properties the wrong way and at the wrong price wasting both the owners’ time and money. Owners that appoint us from the beginning tend to experience a lot less frustration as even though it might not always be what you want to hear we know and understand the products we are selling and what needs to happen to get them sold and that is exactly what we will tell you. It is difficult to articulate this, with the urgency it requires, in writing and hence we prefer to discuss these points with you in detail in person or via a phone call.

Most owners who sell these types of properties will sell them for less than what they paid. This is a trend I’ve seen over my entire career in Real Estate which began back in the Late 90’s.

We often hear people say “well it’s not costing me anything so I’ll just hang onto it” we understand it is difficult to come to terms with selling a property for less than what you paid but depending on your own circumstances why would you hang onto something that is not performing as well as it should and prevents you getting your money into a better quality investment that will not only provide a good return but will also grow in value and will down the track allow you to use it as leverage into other properties if you so choose.

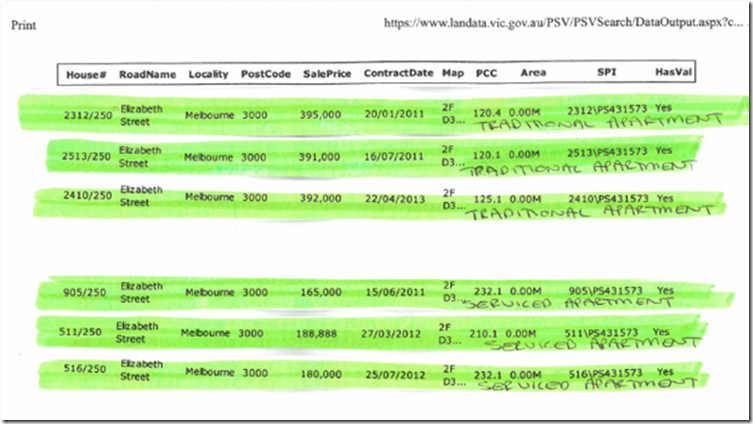

One perfect example of this I can recall is a lady who purchased an Elizabeth Street, serviced apartment no fully understanding the purchase and how it worked. She paid $240,000 in 2001. She was obtaining a 6% net return on the investment. She reluctantly took my advice to sell the property that was “crippling her” we sold the property for $170,000 early in 2009. A loss of $70,000 was a bitter pill and she was very hesitant about re-investing in property. I showed her some traditional apartments in the same building that were not a part of the serviced apartments. It was a one bedroom property facing west with a small balcony and a generous 56m2 of internal space. Given we’d been very accurate on all other predictions for her she took a recommendation from us and purchased the property in mid 2009 for $325,000, she leased the property out for $430pw providing her with a 6.88% gross return, she then watched the property prices of the same apartments in her building jump $60,000 over the next 2 years, where prices then slowed in growth but continued to grow. Her rent also went up in the next tenancy to $450pw.

So as you can see, a property that she lost $70,000 dollars on over 9 years was replaced with a property that provided a very similar return but allowed her to recover her loss over 2 years and then has continued to provide a good return and will continue to grow as the traditional real estate market does.

If she had of bought the property she bought second back in 2001 she would have paid approximately $260,000 and that property is now worth approximately $390,000, giving her a profit on purchase price of $130,000. If she still owned the original property it would still be worth approximately $170,000.

Even though she hasn’t chosen to leverage against her new property she would be quite able to do so given that the property;

· Is a traditional apartment

· Is not a studio (meaning it has a separate bedroom)

· Is 50m2 or larger

· Is not Student Accommodation or a serviced apartment

· The banks are very comfortable with this type of property

(I’ve attached below an excerpt from Landata showing the similar sales in the example above)

An interesting fact: Do you know how to catch a Monkey. Lay large fruit out like watermelon with a small hole cut in the side. When the monkeys come and put their hand in the hole they excitedly grab a handful of watermelon eager to eat it. Once they have a clenched fist of seeds and fruit their hand becomes too large to get back out of the hole rendering them stuck. They stubbornly sit unwilling to let go. They are then captured……

If only they had opened their hand and just Let Go!

If it’s time for you to let go and move onto something better, call one of our expert team today. Talk to them as openly as you can so they can provide you the best quality advice and assistance.